Services

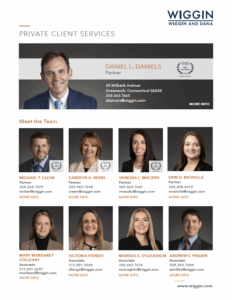

For three decades, Dan has dedicated himself to counseling families in preserving wealth from generation to generation. His clients include affluent individuals, family offices, business owners, C-suite executives and private equity and hedge fund founders. He assists them in estate and business planning, trust and estate administration, probate litigation, and more. He is Co-Chair of the Family Office and Strategic Investments Group.

Dan has been named by Worth Magazine as one of the top 100 trust lawyers in the United States. He is one of seven trust and estate lawyers in Connecticut ranked in Band 1 by the international ranking service Chambers and Partners. Dan is a fellow of the American College of Trust and Estate Counsel and is listed in The Best Lawyers in America. Best Lawyers has also named Dan its Lawyer of the Year for the Stamford area in the category of trusts and estates.

Dan is especially interested in family businesses, having grown up in one. Clients often consider him their personal “general counsel”, seeking his advice on a variety of legal and family matters. If Dan isn’t the right person to answer a family’s question, he puts them in touch with others who can, whether at Wiggin or outside the firm, with the goal of getting the family the best possible advice.

Dan received his J.D. cum laude from Harvard Law School and his A.B. summa cum laude from Dartmouth. He and his family live in Greenwich.

Education

- Harvard Law School (J.D., 1987)

- cum laude

- Dartmouth College (A.B., 1984)

- summa cum laude

Bar Admissions

Awards and Recognitions

Services

News

Services

Publications

Services

Events

Services

Services

Videos